no the banks swapped long term assets (mortgages be it portfolio or MBS securities) for cash. That cash is held at the Fed as Excess reserves. You have to look at both sides of the equation. If "trillions were created out of thin air, where is the rampant inflation? Japan has >200% debt to gdp rate. why are they in deflation for decades.

I wont deny that the stock market has been helped by QE, but that is a peripheral impact. The Fed Buys UST and conforming MBS. In fact they were taking down all production FNMA, GNMA and FHLMC MBS production for almost a year. It doesnt buy stocks.

The US Treasury liabilities (on/off bal sheet) are QE related. They pay for Social Security, medicare, defense, etc. That is completely different than QE The issues existed long before QE. You can make an arguement QE has softened that true impact by creating $200M of income to the Treasury.

The Fed "liabilities" are just bank deposits. Below shows the growth of deposits at commercial banks those deposits are cash(assets for the banks). The fed can shrink the balance sheet though reverse repos, term facility or outright asset sales.

pretty quickly. But new regulation such as the Liquidity Coverage Ratio forces Banks to maintain cash and UST.

Deposits vs loans

Deposits vs loans + excess reserves

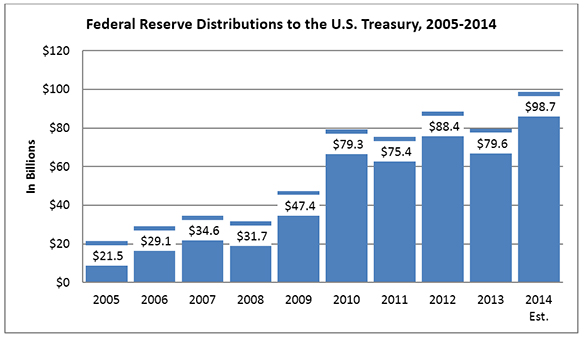

And because the Feb balance sheet includes securities, it has earned interest on those securities that interest is distributed to the US Treasury as interest income. And with rates low, the projected deficit and Debt/service/GDp and Debt service/budget has shrunk.